|

OUR OFFICE

|

SAY HELLO

If you are interested in working with us or just want to say hello simply drop us a line!

Email: info@investmentscy.com Phone: +1 (917) 512-9523 |

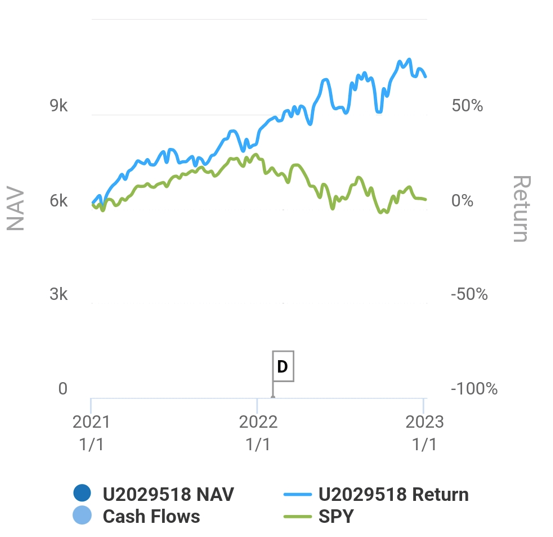

Our Returns As Of 2023

|

RSS Feed

RSS Feed